JuanHand Review – Is this online loan app legit?

JuanHand Review - Is this online loan app legit?

Luciana Jury | JuanHand Review – Is this online loan app legit? | This article examines the legitimacy of the JuanHand online loan application. As the Philippines faces economic challenges and recently, major calamities, we Filipinos have been looking for ways to augment sources of cash for daily living.

Some of us, out of sheer desperation, resort to 5-6 pautang method, even though this comes with an exorbitant interest rate and a high safety risk. But what a lot of Pinoys are not aware of is that 5-6 is illegal as ruled by the Supreme Court and posted in the Securities and Exchange Commission (SEC) Philippines here. So for our fellow Juans who are in urgent need of cash, what are the alternatives?

For the past few years, online loan applications have become more and more popular in our country. It has been one of the most accessible ways to quickly borrow cash without the hassle of going inside a bank. The app can easily be installed on mobile phones through Google Playstore (for Android devices) and the App Store (for iOs devices).

Among the available online loan apps, JuanHand seems to rise above the rest. During the pandemic, not only were they able to assist people financially through their lending app, but they also took the initiative to help our healthcare workers by giving donations of personal protective equipment. Through JuanHand’s mother company, FinVolution Group, they were able to help front liners from Ospital ng Makati, Diosdado Macapagal Memorial Hospital, Asian Hospital, Rizal Memorial Quarantine Facility, Parañaque Hospital, among others.

Providing charitable services is just one of the green flags of JuanHand. Let’s go over some of the other essential green flags that you need to be on the lookout for when looking for the right OLA to use:

Licensing and certification

Legitimate online loan apps are registered with the Securities and Exchange Commission (SEC). They go through a tedious process under the SEC before they are given financing or lending license. Reputable loaning companies are also usually affiliated with credible professional firms.

JuanHand, operated by WeFund Lending Corp., has been given the license to operate by the SEC, with Company Registration No. CS201825672 and Certificate of Authority No. 2844. You may view the SEC website to confirm this. WeFund Lending is a subsidiary of FinVolution Group, one of the leading FinTech Companies in Asia and listed on the New York Stock Exchange (NYSE: Ticker FINV).

Furthermore, JuanHand is affiliated with trusted and acclaimed partners in the industry, such as UnionBank, Lazada, Sun Life Grepa, SkyPay, Multysis along with data partners FinScore, Trusting Social, CIBI Information Inc., and Credit Information Corporation.

Privacy and security

In our JuanHand review, we have looked at online loan apps criteria that makes them legit. In this digital age, every user’s data should be safe and protected. Every person who uses online loan apps such as JuanHand, should know of the risks involving data privacy. There have been quite a few issues surrounding some online loan apps on this matter, and the SEC has been able to address complaints in the past few years by shutting down the operations of some lenders. Even the National Privacy Commission or NPC has been very active in reviewing data privacy protocols of these loan apps.

How do you know if the online loan app you will use is safe and secure? One of the first things you should do is to read through the Privacy Policy in the Terms and Conditions of the OLA. Be sure that you understand and agree with what is being said. Then, before applying for a loan, be wary of the information you will be asked to provide.

On this aspect, we have verified that JuanHand is legit – it is indeed safe and secure to use. JuanHand assures that all client information is protected and encrypted, in full compliance with National Privacy Commission (NPC) regulations. True to the Data Privacy Act of 2012, no confidential information will be asked without your consent so that every Juan’s peace of mind is guaranteed. JuanHand is also compliant with regulatory partners such as the Anti-Money Laundering Council and the Bureau of Internal Revenue (BIR).

Website and Reviews

We now live in a highly digitized world, and almost every legitimate company or institution has its own website where you can view all pertinent information about them. A dependable customer service center is also a must-have for a reliable lending company. Also, customer reviews can give additional verification of how well an online lending app provides its services. Just as how we check reviews about items when we do online shopping, this also gives us insight into the OLA we plan to partner with.

JuanHand not only has a legitimate website (https://www.juanhand.com), but they have an office in Metro Manila as well. Their site office is located at this address: Trade and Financial Tower, 32nd St. Cor. 7th Ave., BGC Taguig, Philippines 1630.

On customer reviews, you can browse Google Playstore or the App Store to see for yourself how efficient and easy to use JuanHand is. Here are a few recent customer reviews just to give you an idea:

These are just the top three (3) green flags you need to verify before getting aboard any online loan app. Definitely, JuanHand deserves applause for getting a check on all three. During these hard times, you can’t just put your trust in anything without any background audit. After doing some good research, now it’s time for a test drive.

In this review, have we answered the question if JuanHand is legit? You bet!

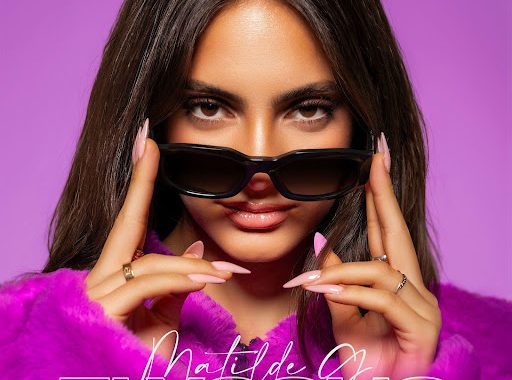

Matilde G Releases New Upbeat Pop Single ‘Ti Voglio’ with Latin Flair On Sept 27

Matilde G Releases New Upbeat Pop Single ‘Ti Voglio’ with Latin Flair On Sept 27  Filinvest Innovation Park – New Clark City welcomes StB GIGA Factory, Marks Bold New Chapter in Philippine Renewable Energy

Filinvest Innovation Park – New Clark City welcomes StB GIGA Factory, Marks Bold New Chapter in Philippine Renewable Energy  Join Benchmark Consulting’s Team Coaching Certification Program with Master Coach Julius Ordoñez and Elevate Team Dynamics for Unprecedented Success!

Join Benchmark Consulting’s Team Coaching Certification Program with Master Coach Julius Ordoñez and Elevate Team Dynamics for Unprecedented Success!  iQIYI Brings Original Malaysian Drama Hit ‘Rampas Cintaku’ to Global Audiences, Amplifying the Reach of Premium Asian Content

iQIYI Brings Original Malaysian Drama Hit ‘Rampas Cintaku’ to Global Audiences, Amplifying the Reach of Premium Asian Content  Sennheiser Launched HD 490 PRO Reference Studio Headphones

Sennheiser Launched HD 490 PRO Reference Studio Headphones  Globe At Home goes after prepaid market with new offers

Globe At Home goes after prepaid market with new offers  Earth Day 2024: Globe advances sustainable telecommunications with energy-efficient network strategies

Earth Day 2024: Globe advances sustainable telecommunications with energy-efficient network strategies